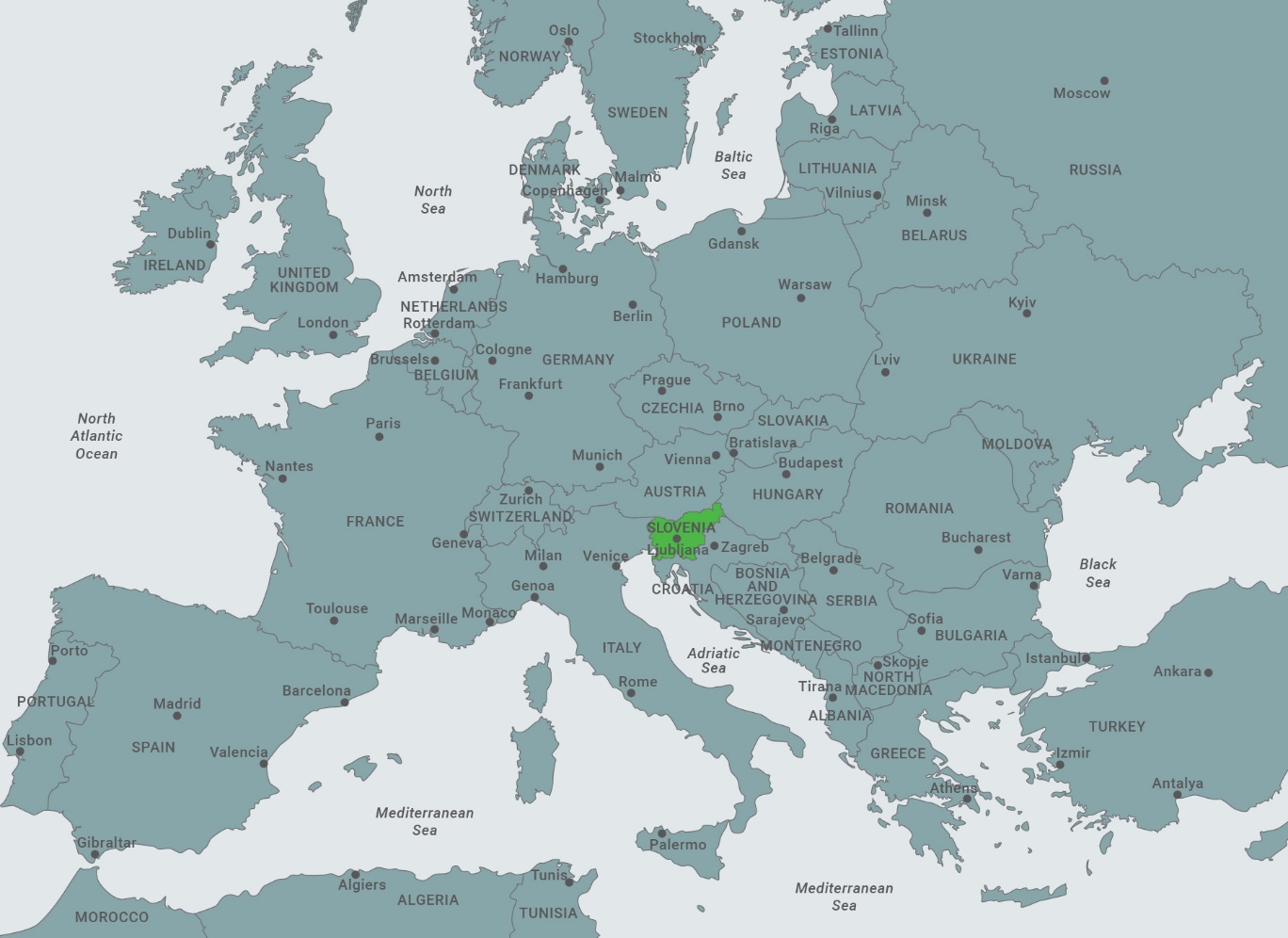

Slovenia in brief

Slovenia is conveniently located in Central Europe in an area of land between the Alps and the Adriatic Sea, bordering Austria, Italy, Croatia and Hungary. It covers 20,273 square kilometres and has a population of 2.1 million.

Despite its small size, Slovenia is a land of great geographic and natural diversity, with a rich history and cultural heritage. Already in ancient times, the Roman cities in this territory held extraordinary significance given their strategic location at the intersection of west and east, while important trade routes like the Amber Road, the oldest and shortest link between the Baltic and the Mediterranean, ran through Slovenia. Slovenians’ ancestors settled in the area in the 6th century AD and established the Principality of Carantania, known for its unique democratic custom of installing their dukes. After the 9th century, Slovenians lost their sovereignty for a whole millennium yet maintained their language and cultural identity. Following World War I, when the Austro-Hungarian Empire of which Slovenians were a part collapsed, they co-established the Kingdom of Serbs, Croats and Slovenians, later the Kingdom of Yugoslavia. After World War II, Slovenia became part of socialist Yugoslavia and its most prosperous federal republic.

Slovenia declared its independence in 1991 and became a European Union member in 2004. In 2007, it adopted the euro as its national currency and joined the Schengen area. Today, it is a democratic, stable and successful country with high GDP per capita and consistent economic growth, a member of the main international organisations and a country that enjoys friendly ties with other countries.

Slovenia is a fast-growing, export-oriented economy. Services account for the majority of the country’s total value added. Knowledge is one of the main pillars of national development; in a few research areas like computer science and nanotechnology, Slovenia ranks among the top countries in the world. Among CEE countries, it is also a leading innovator according to several innovation-related indicators (including aggregate R&D intensity).

Not many countries, even much bigger ones, have the wonderful landscape diversity found in Slovenia, a place where the major European geographical units – the Alps, the Pannonian Plain, the Dinaric Karst and the Mediterranean – meet and overlap. Slovenia has three different climates: sub-Mediterranean in the coastal area, Alpine in the northwest, and continental elsewhere in the country. Slovenia also enjoys extreme biological diversity; it is one of the most water-rich countries in Europe, and one of the few countries in the world where all tap water is safe to drink. Almost 60% of Slovenia is covered by forest, making it the 3rd-most forested country in Europe, with up to 39% of its territory being protected by the Natura 2000 ecological network, i.e. the highest level in the EU. In 2016, Ljubljana, the capital of Slovenia, was declared the Green Capital of Europe, while in 2020 it was named one of the most sustainable developed tourist destinations in Europe (ITB Berlin).

Slovenia has historically been a crossroads of Slavic, Germanic, Romance and Ugric languages, cultures and influences, which have all shaped its character. Slovenians may be described as diligent, active people who are well educated and adept at speaking foreign languages. Slovenians are above the OECD average in terms of positively perceiving their quality of life in areas like jobs, education and skills, work–life balance, social connections, environmental quality and personal security. It is also one of the countries with the lowest income inequality as measured by the Gini coefficient. Slovenia is among the 10 safest countries in the world (Global Peace Index) and one of the best with respect to reliability, accessibility and environmental sustainability in the field of energy (WEC).

With its wonderful natural landscapes, ancient historical sites, modern facilities, friendly and talented people along with dynamic entrepreneurs, Slovenia makes a great place to visit or live, do business … and enjoy.

Basic data

| Official name | Republika Slovenija (Republic of Slovenia) |

|---|---|

| Form of state | Democratic parliamentary republic |

| Area | 20,273 sq. km |

| Capital | Ljubljana |

| Population (2023 Q1) | 2,116,972 |

| Language | Slovenian |

| National currency | euro (EUR) |

| GDP growth (2022) | 5.4% |

| GDP per capita (2022) | €27,975 |

| Annual inflation rate (April 2023) | 9.4% |

| Annual basic interest rate (May 2023) | 9.84% |

| Exports of goods and services (2022) | €52,776 million |

| Main destinations of exports (2022) | Germany, Italy, Croatia, Austria, France |

| Imports of goods and services (2022) | €56,744 million |

| Main origins of imports (2022) | Germany, Italy, Austria, Croatia, France |

| Unemployment rate - LFS (2022 Q4) | 3.5% |

| Gross monthly earnings (February 2023) | €2,132.58 |

| Net monthly earnings (February 2023) | €1,391.65 |

Reasons to do business in Slovenia

Slovenia is a member of the European Union, Schengen Area and euro area, providing access to the EU market that has 500 million customers and no customs and duties. Slovenia is also an excellent starting point for entry into the markets of Eastern Europe and the Balkans, where it is favoured by free-trade agreements, excellent knowledge of these markets and well-established business ties.

Taking advantage of its exceptionally good geo-strategic position in Central Europe at the intersection of two TEN-T corridors (the Mediterranean and the Baltic-Adriatic), Slovenia provides hinterland access via land and sea, offering the shortest connections to the Mediterranean via Port Koper and to the Middle and Far East via the Suez Canal. Modern port infrastructure and well-situated infrastructure for inland freight transport ensure goods are moved quickly and reliably, customs clearance processes are efficient, and supply chain costs are low. According to the World Bank’s Doing Business indicators, Slovenia’s business environment scores best in the category Trading across Borders, where it appears alongside world leaders.

Slovenia offers a stimulating and low-risk business environment. Starting a business is fast and simple. A corporate culture of transparency and accountability, observance of international technical standards, personal integrity and company loyalty make a foreign manager’s job easy. The governmental policy aimed at developing a favourable tax system and investment tax relief, labour market flexibility, the deregulation of industry and elimination of administrative barriers is complemented by a broad system of incentives supporting foreign direct investments. This means it is no surprise that Slovenia ranks as one of the least restrictive OECD member countries for foreign direct investment, having doubled its FDI stock over the last 10 years. Investments that address priority goals like investments in services and R&D, the creation of high qualified jobs and high value added and sustainability projects are particularly encouraged. These instruments of the government’s proactive investment policy not only serve to stimulate new investments but also motivate foreign investors already present in Slovenia to increase their activities while expanding and upgrading their existing facilities.

One of Slovenia’s important comparative advantages is the quality and commitment of its workforce, characterised by a share above the EU average of people holding a secondary and tertiary education, excellent foreign language skills (with 37.7% of the population speaking at least three languages, ranking Slovenia third in the EU according to Eurostat), a flair for technology and innovation and a high level of digital literacy. Education and training are focused on supporting high-tech and other high value-added sectors such as information and communication technology, pharmacy and life (biological) sciences. It also has more researchers in R&D per capita than most CEE countries.

Slovenia has very well-developed ICT infrastructure and services. The country exceeds the EU average in: overall fixed broadband take-up; Internet usage of online news sites; newspapers or news magazines; electronic sales to other EU countries; pre-completed forms; online service completion; and open data. Slovenia is also increasingly covered by 5G technology. Access to eGovernment services is excellent and almost all administrative and business procedures can be performed online.

Slovenia has always managed to prove its relatively strong resilience to internal and external challenges, even at times of great uncertainty. In view of the Covid-19 pandemic, short-term economic policy priorities have concerned preventing the virus’ spread and reducing its socio-economic consequences. Extensive government measures have been adopted to support employment and business while limiting insolvencies. The latest economic data show that especially export-oriented companies have managed to quickly adapt and remain agile during these uncertain times. Despite the current setback caused by the health crisis, Slovenia is also at the forefront of countries transitioning to a circular economy, one that focuses on sustainability, green technologies, and corporate social responsibility. Slovenia has always managed to rise to the challenge and to move forward more experienced and better prepared for any recurrences while looking forward to new opportunities. This means the country will remain attractive as an investment destination and Slovenian companies will be reliable business partners also in the future. While the Covid-19 pandemic brings new structural changes, a boost to de-globalisation efforts and different preferences and expectations, it will also further accelerate the already swift digital transformation process, representing for Slovenia a big opportunity to continue its path towards the future.

Economic trends

Solid growth fundamentals despite great uncertainty due to the pandemic

In the decade prior to the outbreak of the Covid-19 pandemic Slovenia enjoyed strong growth and economic development. Resource and energy efficiency increased, public finance and the banking system successfully recovered from the global economic and financial crisis. The relatively high economic growth has seen the gap in GDP per capita with the EU average narrow since 2016 while the material conditions for well-being have improved.

Between 2014 and 2019, the Slovenian economy experienced economic growth, mainly driven by increasing exports resulting from foreign demand and the improved competitiveness of Slovenian exporters. Market share, an indicator of export competitiveness, was rising, supported by moderate unit labour cost developments and a favourable export destination mix. Besides the growing exports, domestic consumption became an increasingly important factor in economic growth. However, in 2019 economic growth slowed down, yet remained visibly higher than the EU average. Such growth reflected disruptive changes occurring in the international environment and the slowdown in Slovenia’s biggest trading partners. Domestic demand became the most important driver of growth. Private consumption continued to rise, supported by robust labour market developments and higher household disposable income. Boosted by favourable economic trends, employment recovered fast after the crisis and in 2019 reached its highest level, while unemployment was approaching record lows (LFS, 4.5% in 2019).

2020 saw dramatic changes to the world economic environment. With the high uncertainty and disrupted global supply chains due to the Covid-19 pandemic, international trade contracted sharply, as did investment. The strict measures to contain the virus’ spread caused a big decline in economic activity globally and in Slovenia. This drop was the most pronounced in the second quarter, given the closure of businesses involved in non-essential service activities and hampered activity in industry and other service activities. In 2020, real GDP in Slovenia shrank by 5.5%, namely less than the EU average and also much less than previously expected by international institutions. The favourable labour market developments seen in the years before were interrupted by the first wave of the epidemic, yet any bigger decline in employment or worsening of the labour market situation was prevented by intervention measures. The large drop seen in activity during the first wave was followed by a swift recovery in the summer months. During the second wave, the impact was felt much more by service activities whose activities had been restricted or not allowed due to the re-imposed containment measures, i.e. entertainment, sports, recreational and personal services, accommodation and food service activities, and a considerable share of the trade sector. The effect on activity in these sectors was significant, also leading to a substantial fall in household consumption. On the other hand, certain other activities, particularly those related to external trade (transport and manufacturing), along with some activities connected with the local economy (construction), were considerably less affected during the second wave.

Nevertheless, the Slovenian economy has been able to show its adaptability and resilience amidst exceptional circumstances. The economy, especially the foreign-trade-oriented manufacturing industry, has adjusted and coped with the second wave significantly better than the first wave. The rapid recovery of employment has been recorded, particularly in manufacturing and transport.

The government promptly responded by adopting several large stimulus packages, totalling around EUR 3.5 billion (According to Fiscal Council, the total direct effect of the Covid-19 measures in the period March 2020–February 2021 has been EUR 2.96 billion, while the total cost of such measures, taking account of the potential effect of guarantees on the overall state budget, liquidity loans and deferred credit payments, is EUR 3.49 billion.). Direct support measures have been instrumental in preventing and easing the economic and social impact of the Covid-19 pandemic. Notably, wage compensation for temporary lay-offs, subsidies for shorter work hours, and basic monthly incomes have preserved jobs and prevented any more severe downturn in the labour market. With additional measures aimed at businesses (a freeze on advance payments of income tax, VAT and some contributions, loan moratoria, state guarantees, subsidised loans) a bigger output loss was averted, thereby safeguarding financial stability and ensuring the economy’s liquidity. At the same time, the government introduced measures to ease the administrative burden which, together with the stimulus packages, will help pave the way for a stronger rebound in 2021.

Like in previous years, the sound economic fundamentals remain in place. The smaller than expected negative impact on export-oriented activities and goods trade during the second wave and the wider availability of vaccines set the stage for a solid rebound in 2021. Relatively strong growth in investment, especially in infrastructure and housing, is anticipated. With a good labour market situation and greater possibilities to re-open borders to tourism and travel, the faster growth of private consumption is again expected in 2022. The current account surplus remained high in 2020 and is expected to also remain high in the following years (Detailed macroeconomic analyses and forecasts can be found at: https://www.umar.gov.si/en/).

Export sector with a solid outlook and foundations

After several years of high and robust growth, exports declined sharply in 2020 (-8.7%) due to the worldwide effects of the Covid-19 pandemic, especially in Slovenia’s main EU trading partners. A pronounced fall in exports was recorded particularly in the second quarter, which also largely explains the decline in the year as a whole. The year-on-year decline in goods exports decreased gradually in the second half of the year, while in the last quarter of 2020 goods exports were already positive year on year. This shows the resilience of Slovenia’s manufacturing and its exports, especially due to its geographical and product versatility and structure. In trade in most services, the decline was bigger than in goods. It was the most pronounced in tourism-related services, whereas in the second quarter trade in transport services also dropped significantly.

Geographical and product versatility are some of the key factors that explain the success of Slovenia’s export sector. In 2020, Germany, Italy, Croatia, Austria and France remained the most important trade partners in the EU, accounting for over one-half of total goods and services. Trade is also strong with certain non-EU countries, notably Switzerland, Russia and Serbia. It should be stressed that Slovenia is becoming an ever more important distribution and logistics hub within Europe.

In total, 21 countries held at least a 1% share of total Slovenian goods exports, with the rest of the world still representing over 14%. Nevertheless, Slovenia is highly dependent on the EU market, as indeed are most other countries in the EU. The large share of exports to the EU (around 75%) indicates the country’s high level of integration into the European market and European supply chains, particularly in the euro area, which means less exposure to exchange rate fluctuations, but also greater exposure to shocks within the EU. However, the integration with Germany as the most important trade partner (19.9% of goods exports) helped immensely in the recovery seen in late 2020. Slovenia’s geographical dispersion of exports4 is similar to the EU average, although higher than in other countries of Central and Eastern Europe.

The technological structure of manufacturing exports continued to improve as the share of medium/high-tech products has been gradually rising. Highly involved in global supply chains, Slovenia’s exports are largely intermediate goods, representing more than half of total goods exports in the last year, followed by consumer goods with (over one-third) and investment goods. The great uncertainty and disrupted global supply chains due to the Covid-19 pandemic hit the automotive industry especially hard, although road vehicles (including spare parts) maintained the biggest share of exports (around 15%) in 2020, followed by medicinal and pharmaceutical products (12%–13%), electrical machinery and appliances (10%), general industrial machinery and equipment (around 5%), and metal products (4.4%). It should be noted that the share of high-tech products increased in 2020. The product concentration of exports is slightly higher than the EU average, but lower than for most of its neighbours in Central and Eastern Europe.

Services exports (around 20% of all exports) are dominated by travel and tourism and transport services (road haulage being the main part), but also include sectors like Information and Communication (ICT) and construction services. The services sector has been hit strongly by the Covid-19 pandemic, although most services (except for tourism) started to recover in the third quarter of 2020.

Import growth halted, while the outlook is positive

After several years of strong growth, imports decreased by 10.2% in 2020. This was caused by the effects of the Covid-19 pandemic and consistent with the movements of exports and activity in industrial production in Slovenia. After a large decrease in Q2, goods imports recovered at a similar pace as exports and reached their 2019 levels towards the end of the year. Notably, the effect of the crisis was greater on imports of domestic consumption goods and imports of services.

The geographical and product structure of imports is varied. In 2020, Germany, Italy, Austria, Croatia and China were the biggest exporters of goods to Slovenia, together representing slightly over 50% of total goods imports. Despite this, imports remained geographically dispersed since 21 other countries held at least a 1% share in Slovenia’s total goods imports, while the rest of the world still represented around 11%.

Among imported goods, road vehicles kept the highest share at around 11%, followed by electrical machinery and appliances and medicinal and pharmaceutical products (both between 7%–8%), with mineral fuels and general industrial machinery and equipment around 4.5%. The exceptional year saw a big drop in imports of mineral fuels, and an increase in imports of medicinal and pharmaceutical products due to the health crisis.

Public finances supportive of the economy’s recovery

Public finances improved markedly between 2015 and 2019. The favourable economic situation and measures to stabilise the fiscal position enabled the continuous improvement of the general government balance, which was balanced in 2017 and in surplus in 2018–2019. Revenue growth remained solid in 2019 (4.8%), while the growth of expenditure was the same as in the previous year (5.2%). General government debt was on a downward path for the fourth consecutive year, reaching 66.1% of GDP at the end of 2019, remaining well below the EU average.

In 2020, the impact of the Covid-19 pandemic was softened by the extensive government measures to support the economy and employment and limit insolvencies. These measures are reflected in the considerable increase in general government expenditure, while losses in revenue due to the economic contraction and restrictions imposed on a range of economic activities were moderate (-4.6%). After 5 years of significant improvement and due to the exceptional circumstances, the general government balance worsened (-8.5%), whereas general government debt increased substantially to 80.8% of GDP by the end of year. However, fiscal support is set to remain strongly supportive until the recovery is well underway and therefore the budget plans for 2021 retain the support to fight the Covid-19 crisis’ consequences and are complemented by new resources under the Next Generation and Cohesion Policy EU instruments.

General government financing conditions continued to remain favourable during the Covid-19 pandemic. In 2020, the required yield on long-term government bonds fell below 0% towards the end of year as investors were expecting economic policymakers to extend the existing measures for as long as needed. The solid macroeconomic fundamentals are also reflected in the spread of Slovenia’s long-term bonds over a comparable German bond, which remained comparatively low (below 50 basis points in 2020) and lower than before the outbreak of the epidemic. Slovenia’s interest payments to revenue ratio declined from 7% in 2015 to 3.9% in 2019 and is expected to also continue declining in the following years.

A well-capitalised banking sector with stable profits

The profitability, solvency and asset quality of the banking sector was on an upward trend in the last years and also remained in a good condition in 2020. Return on equity in 2020 reached 9.6%, slightly down from 2019 (12.2%). The banking system operated in exceptional circumstances in 2020, while the impact of the Covid-19 pandemic may be expected to continue to be shown in its future performance.

Slovenia’s banking sector remains well capitalised, enjoying stable profits. The resilience of the country’s banking system during the adverse economic situation caused by the Covid-19 pandemic remains relatively strong, while the banks’ capital and liquidity position is significantly better than it was before the previous global financial crisis. On a consolidated basis, the capital adequacy ratio increased above the euro area average, standing at 20.0% in September 2020. The liquidity position was once again favourable, while banks recorded profits for the sixth year in a row. Despite the downturn in business conditions, the banking system recorded relatively high pre-tax profits (EUR 472 million), down by just one-fifth on the previous year.

According to the Bank Lending Survey, credit standards were tightened for corporate and household loans in late 2019 and 2020. With the introduction of a binding macroprudential instrument in Q4 2019, the growth structure of loans changed towards a bigger share of housing loans, as the contraction in consumer loans was significant in 2020. Still, the banking system’s exposure to the real-estate market remains relatively small: the ratio of housing loans to GDP is the lowest in the euro area. In the period 2017–2019, the annual growth of loans to non-financial corporations stayed low as firms are more heavily relying on their retained earnings, which are plentiful due to the high profits made by the corporate sector. Such growth remained weak in 2020, mostly as a result of the uncertainty brought by the Covid-19 pandemic. The continuous economic growth in the previous period and banks’ own efforts mean that non-performing exposures were falling until the start of the pandemic. They only started to rise in the last quarter of 2020 and are anticipated to further increase when the loan moratoria (an anti-crisis measure) expire. Deposits by the non-banking sector rose considerably in 2020. This was due to the increase in household deposits (10.1%) while non-financial corporations declined (18.6).

A stable and predictable business environment

Global competitiveness is crucial for tackling the challenges of new technologies and taking advantage of the opportunities they bring. In 2019, the World Economic Forum ranked Slovenia 35th out of 141 countries in the Global Competitiveness Report, noting its stable macroeconomic environment, well-developed human capital and well-established innovation ecosystem.

Slovenia’s business environment is stable. The World Bank’s Doing Business 2020 indicators see Slovenia placed 37th among 190 economies. It is found in the upper half of EU member states, ahead of Portugal, Poland, Czech Republic and Hungary, among others.

Slovenia’s business environment scores best in the category Trading across Borders, where it appears alongside other leaders because it is deeply integrated into global supply chains and exploiting its strategic geographical position at the crossroads of Europe. Other dominant features include efficiency in resolving insolvency issues, where it scores 8th on the global scale, protection of minority investors (18th) and ease of getting an electricity connection (23rd). According to the World Bank’s Worldwide Governance Indicators, Slovenia scores 10th among EU member states for political stability and lack of violence.

According to the Corruption Perceptions Index published by Transparency International, Slovenia is one of the 35 least corrupt countries out of the 180 countries covered by the 2020 report. Within the EU, it is found in the middle, behind Portugal and Spain, but ahead of Poland, the Czech Republic, Slovak Republic, Croatia and Hungary, among others. Similarly, Slovenia ranks 42nd among 209 countries according to the World Bank’s Control of Corruption Index, and again appears in the middle of the EU rankings.

The corporate tax rate is competitive in both the global (on average 23.8%) and EU (on average 20.9%) contexts. At 19%, Slovenia’s corporate tax rate is one of the lowest in the EU in 2021. As a share of GDP, fiscal revenues from the taxation of capital are only one-half of the EU average, with revenues from the taxation of labour slightly below the average.

Foreign direct investment continues to rise, albeit more slowly due to the current situation

FDI continues to flow into the favourable investment environment. In the years before the Covid-19 pandemic, FDI inflows reached around EUR 1 billion. FDI was dominated by equity investment and reinvested earnings, while changes in debt instruments were negligible. In 2020, the effects of the Covid-19 pandemic saw FDI inflows being halved, reaching just below EUR 0.5 billion. The stock of FDI amounted to EUR 16.6 billion (35.9% of GDP), namely EUR 7.9 billion more than in pre-crisis 2008 and more than EUR 7 billion more than at the end of 2013 when the new period of economic growth began.

Based on the latest available data, FDI mainly originates from the EU (82.6%). Austria’s share (24.7% of the total stock of FDI) remains dominant and slightly increased in 2019. At 13.0%, Luxembourg was the second-most important FDI source, followed by Switzerland (11.4%), Germany (8.5%), Italy (7.9%) and the Netherlands (6.5%). The complex structures of multinational firms, which are a response to several factors, may conceal the ultimate source of inward FDI. The largest ultimate investors come from Germany, Austria, Italy, the USA and Switzerland, and account for over half of all investments.

Foreign investors invested most heavily in the corporate sector, which accounted for 77.6% of total inward FDI in value terms by the end of 2019. FDI is traditionally focused on the manufacturing sector, attracting 32.9% of the total stock of FDI. Manufacturing is followed by the financial and insurance sector (22.3%) and wholesale and retail trade, repair of motor vehicles and motorcycles (17.6%). An important share of FDI is accounted for by real-estate and information and communication services.

Slovenian outward FDI also continued to grow in 2020. With a stock of around EUR 7.0 billion (15.3% of GDP), it went up by almost EUR 2 billion over 2013. As investors, Slovenian corporates have traditionally focused on the Western Balkans, where they possess detailed knowledge of the local markets. The territory of former Yugoslavia accounted for almost 70% of the total stock of outward FDI in 2019, with Croatia holding 37.8%, Serbia 15.3%, Bosnia and Herzegovina 8.9%, and Russia 7.5%. A notable share of 6.9% was also directed to North Macedonia, while the Netherlands accounted for approximately 3.1% of outward FDI.

Similar to inward FDI, outward FDI was also mainly (33.6%) directed to manufacturing activities. Manufacturing was followed by wholesale and retail trade, repair of motor vehicles and motorcycles (18.5%), financial and insurance activities (12.7%) and professional, scientific and technical activities (6.7%).

Slovenia’s key points of attraction

According to the OECD’s Better Life Index, safety, the work–life balance, the community and health are the qualities most cherished by those living in Slovenia. Ideally situated in the centre of Europe, close to the main transport routes, Slovenia also has access to and knowledge of the regional markets in Europe’s east and southeast. Foreign investors are especially attracted to the country by the quality and level of education, the skilled labour force, the developed scientific infrastructure and reliable basic infrastructure. This is all supported by a stable macroeconomic environment in the EU environment and sound public finances.

High quality of living

According to the United Nations’ Human Development Index (HDI), Slovenia enjoys some of the highest living standards in the world. In the 2020 report, it is ranked 22nd among the 189 surveyed countries, while its HDI ranking exceeds the EU average.

Slovenia was placed slightly below Austria, but ahead of Spain, the Czech Republic and France, among other member states. Among EU members, Slovenia’s strongest feature is the high number of expected years of schooling while, in global terms, Slovenia scores well in the categories of life expectancy at birth and gross national income per capita. There is also a downward trend in the share of people at risk of poverty, which is one of the lowest in the EU. Income equality, as measured by the Gini coefficient, is the 2nd highest in the EU and one of the highest in the world. The inequality-adjusted HDI ranks Slovenia even higher, in 9th place.

Strong human capital

Slovenia focuses on education, training and industry-driven research so as to be able to offer the best to the high-technology and other high value-added sectors like information and communication technology, pharmaceuticals, and life sciences. The OECD’s PISA project shows that in mathematics, science and reading literacy Slovenian 15-year-olds perform well above the EU average. According to Eurostat, in 2019 Slovenia met both Europe 2020 goals for education: 44.9% of people aged between 30 and 34 had completed tertiary education, and less than 5% of those aged between 18 and 24 had left schools early.

The Digital Economy and Society Index (2020) states that human capital is one of the country’s strengths. IT skills and digital literacy are well developed and over 60% of the population is able to converse in at least two foreign languages and has command of two or more foreign languages. English, German, Italian and languages from the territory of former Yugoslavia are widely used and French language courses are very popular. According to the IMD’s World Competitiveness Report (2020), Slovenia ranks 7th among EU countries for language skills that meet the needs of enterprises, doing better than all of its neighbours in Central and Eastern Europe.

A solid innovation environment and performance

Slovenia’s innovation environment and associated performance are solid. The European Innovation Scoreboard 2020 ranks Slovenia among moderate innovators like Spain and the Czech Republic, with the innovation system’s strengths seen in human resources, business investments in R&D, and ICT training. Slovenia is also an innovation-friendly environment, offering 100% tax relief on R&D expenditure.

At 2.04% of GDP in 2019, Slovenia’s expenditure on research and development is just below the EU average.

Expenditure has been driven by business R&D expenditure, which stood at 1.51% of GDP in 2018 (above the EU average of 1.46%). Business expenditure on R&D is mainly concentrated in pharmaceuticals, machinery, computer technology, and technologies related to electric energy. Public R&D expenditure (0.52% of GDP) is currently modest, yet rising.

The number of researchers grew by more than 4.3% in 2019 and is accelerating faster than in the EU (3.8% on average), showing an almost 50% increase over one decade ago. The biggest share in the total number of researchers is held by the business sector (more than 60%), whereby the number rose by over 500 in the last year, which might give the basis for a new development impetus for innovation while providing more favourable conditions for R&D in the public sector.

An attractive tourist destination

Slovenia is an award-winning tourist destination. It is small, yet incredibly diverse. The large number of awards received in recent years confirms that Slovenia is a green, active and healthy destination. As a top destination in the area of sustainability, it was named winner of the Best of Europe category for 2020 Sustainable Destinations Award (ITB Berlin). Safety plays a major role in selecting holiday destinations and the travel industry is very aware of this. The annual Travel Risk Map ranked Slovenia as one of the safest countries to visit in 2020.

It is worth noting that the blend of cuisine and award-winning wines makes Slovenia a very popular culinary spot, with its capital Ljubljana being included among the world’s best culinary destinations. In 2020, the Michelin restaurant guide presented six restaurants in the country with Michelin Stars (one restaurant with 2 stars). Further, six Slovenian chefs and restaurants were given the Michelin Sustainability Award that highlights industry role models of sustainable gastronomy.

The country’s great attractiveness ensures buoyant tourism revenues. Visitors come to Slovenia from around the globe. Tourists from Germany, Italy and Austria hold the biggest shares, followed by those from the Netherlands, Croatia, Hungary, the United Kingdom, the Czech Republic and Serbia. In recent years, Slovenia has also been becoming increasingly popular among overseas guests, although the Covid-19 pandemic and the world trade restrictions temporarily have halted this positive trend.

Europe’s gateway to global markets

Slovenia’s geographical position at the crossroads of Central Europe is ideal for connecting global and regional businesses. Goods can be moved quickly and reliably, clearance procedures are efficient and, once goods enter Slovenia via road, rail, air or sea, they are on the doorstep of the EU market with 500 million consumers, with many of them being found in Europe’s east and southeast. The country’s strategic location is also reflected in transport revenues. Despite the growing uncertainty in global trade, revenues from transport and storage activity continued to grow in 2019, increasing by around 3%. The Covid-19 pandemic also hit the transport sector hard in the first half of 2020, yet a clear rebound was observable in the second half of the year.

Two TEN-T Core Network Corridors (Baltic–Adriatic and Mediterranean) intersect at Ljubljana. Transit traffic has always played an important role in traditional transport, while in recent years there has been a clear upswing in road and rail transport services. Slovenian companies’ excellent track record in this line of business coupled with the country’s modern transport infrastructure are a proven recipe for the high-quality and cost- shipping services, goods handling, warehousing, safety of deliveries, maritime and inland logistic terminal operations and a range of additional services to suit clients’ needs.

Modern motorways link the Central and Western European markets with the Mediterranean trading routes. The motorway density in Slovenia is higher than the EU average (3.8 km road/sq. km of land area), just after Belgium, the Netherlands and Malta. According to the Ministry of Infrastructure, significant investment projects are planned to further modernise and extend the road infrastructure.

Railroad freight traffic is well developed. The rail links between the Adriatic Sea and the landlocked countries in Central and Eastern Europe offer quality logistics solutions. The broad network of railway lines enables door-to-door cargo transport services while the shunting yard in Ljubljana guarantees quick transport across Slovenia. Both freight and passenger services with south-eastern Europe have expanded in the last few years. In 2019, Slovenian Railways transported 21.9 million tonnes of goods, most of it internationally. Since the railway service is regaining its importance, modernising the infrastructure along the Pan-European Transport Corridors V and X is a national priority. This large-scale upgrade is expected to be finished by 2025, allowing for a further improvement in the quality and capacity of the country’s logistics services.

The Port of Koper serves as a popular departure point for the European export sector and an entry point for Asian and other products destined for European markets. In 2019, 22.1 million tonnes of goods were handled in the port, of this 40% (8.9 million tonnes) were goods in large containers. The throughput of goods in containers has been growing in recent years (overtaking ports in neighbouring countries) since the Port of Koper boats the largest container terminal in the northern Adriatic. In the last decade, the throughput of goods increased by more than 50%, especially large was the increase in trade of goods in containers (145%). In the last decade, the throughput of goods has risen by more than 50%. The Port’s capacities are to be further expanded, while an additional boost to the transport activity will come from modernisation and extension of the railway infrastructure.

Slovenia has three international airports (Ljubljana, Maribor and Portorož). Ljubljana’s Jože Pučnik Airport is located 25 km from the capital and is the main airport in the country for personal and cargo traffic. Regular and charter flights carry passengers to the most important European destinations. The airport is in the process of continuous expansion and upgrading as it moves to become an important regional distribution and logistics centre.

The main reference points

Slovenian diplomatic, consular and other representatives abroad

Economic diplomacy encompasses all relevant activities of the Ministry of Foreign Affairs and includes the 57 diplomatic missions and consular posts of the Republic of Slovenia along with their 22 economic counsellors. Activity in the area of economic affairs is the primary task of every Slovenian ambassador. Honorary consuls are also actively involved in economic diplomacy.

The Directorate for Economic and Public Diplomacy incorporates the Department for Bilateral Economic Relations, the Department for Bilateral Economic Relations II and the Department for Public Diplomacy and International Cooperation in Culture. Its chief task is to ensure the efficiency of economic diplomacy through coordination and management within the broader Slovenian foreign policy system.

In this context, the Directorate cooperates with other players in the area of internationalisation of the Slovenian economy, including: the Ministry of Economic Development and Technology, the Ministry for Public Administration, the Ministry for Agriculture, Forestry and Food, the SPIRIT Slovenia, the Chamber of Commerce and Industry of Slovenia, the Chamber of Craft and Small Business of Slovenia, and the SID Bank.

SPIRIT Slovenia

The key reference point for foreign investors and companies wishing to do business is SPIRIT Slovenia - Slovenian Public Agency for Entrepreneurship, Internationalisation, Foreign Investment and Technology.

SPIRIT Slovenia, the government’s business development agency, is a single contact point for investors and international companies looking for new business opportunities.

The agency has been promoting Slovenia’s companies, business image and the country’s attractiveness as an investment location since 1995. It is entrusted with several regulatory, expert and development tasks that help to raise the Slovenian economy’s competitiveness in the areas of entrepreneurship, internationalisation, foreign investment, and technology. SPIRIT Slovenia is financed by the Ministry for Economic Development and Technology.

Assisting investors

SPIRIT Slovenia assists investors throughout the entire investment process by:

- providing detailed information on local investment opportunities upon request,

- giving guidance concerning site location and support during the selection,

- establishing connections with specific professional services and arranging introductions with sector experts and other relevant authorities, and

- ensuring the inclusion of Slovenia-based investors in the aftercare programme to help accelerate your company’s growth in Slovenia and beyond.

Helping business find the right supplier

The agency supports foreign businesses searching for Slovenian suppliers, products and services by:

- providing a database of all Slovenian exporters and the distribution of enquiries to relevant Slovenian companies,

- offering tailor-made counselling about Slovenian suppliers, industries and local authorities upon request,

- organising tailor-made B2B events for introducing Slovenian suppliers to particular foreign buyers, and

- arranging business delegations and collective presentations of Slovenian companies at international trade fairs.

SPIRIT Slovenia offers so much more than advice, find out more here: www.sloveniabusiness.eu

CMSR

The Centre for International Cooperation and Development (CMSR) is an independent non- profit research and advisory organisation in the field of international economic relations. CMSR implements some of the Slovenian bilateral international development cooperation pursuant to the International Development Cooperation and Humanitarian Assistance of the Republic of Slovenia Act.

CMSR supports the cooperation of Slovenian and foreign companies by providing business information about Slovenian and foreign markets. Its research activities focus on European countries, including those in its neighbourhood, and globally. CMSR specialises in providing economic and institutional country and sector analyses, risk assessments, and other on-demand services for ensuring a successful entrance to emerging markets.

The CMSR has also been publishing the business guide “Doing Business in Slovenia” since 1993, also available in the form of an e-book at the Slovenian Business Portal (www.poslovniportal.si).